Tokenization

Tokenization provides online retailers with an innovative and secure way of handling payments.

What is Payment Tokenization?

In the world of payments, the card account number is masked by a single-use randomized alphanumeric character of the same length, each account number is now a ‘Token’ representing the original confidential information.

The pandemic fostered digital transactions at a faster pace than ever before indeed. As there is an increase in digital commerce, businesses came up with enhanced solutions that facilitated online transactions to confront consumer preferences.

The consumers are worried about their sensitive data being visible to many online platforms, the merchants fret about losing loyal customers. Tokens are the roadblocks effectively as the original data (ex: credit card number) never reaches the merchant’s server.

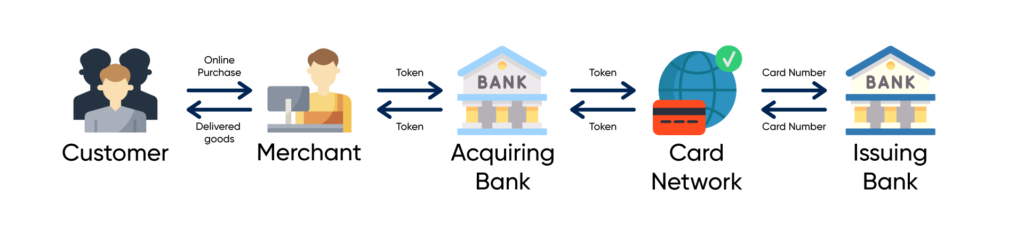

How does credit card tokenization work?

Credit card tokenization substitutes sensitive customer data with a one-time alphanumeric ID. This randomly generated token is used to access, pass, transmit, and retrieve customers’ credit card information safely.

Tokens don’t contain any sensitive consumer data. They rather act like maps explaining where the customer’s bank is storing this sensitive data within their own systems. Tokens are generated through mathematical algorithms and they can’t be reversed.

Outside of your system, these tokens have no meaning and no value. So even if hackers somehow encounter your customer’s data while it’s being processed, they will not be able to use it.

Here is how the tokenized credit card transaction works: